Leverage Your Form 990 to Showcase Your Strengths

Nonprofit organizations often rely on donations and grants to fund their activities. To maintain transparency and compliance, nonprofits are required to file an informational return with the IRS in the form of a 990. While it might seem like just another piece of paperwork, understanding and strategically using Form 990 can be a powerful tool for showcasing your organization’s strengths and mission impact.

Understanding Form 990 offers business owners:

Inspiration for Fresh Perspectives

Understanding Form 990 can inspire organizations to view it not just as a tax requirement but as an opportunity to communicate their mission and achievements effectively.

Enhancing Disclosures

A well-prepared Form 990 allows nonprofits to enhance their disclosures, providing stakeholders with a clearer picture of their activities and financial health.

Flexibility in Reporting

Nonprofits have choices when completing the 990, allowing them to tailor the report to highlight their strengths and achievements.

It’s essential to note that Form 990 is open to public inspection. This means that donors, grantors, and the general public can access this information, making it even more crucial to ensure your Form 990 reflects your organization’s strengths accurately.

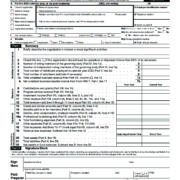

Key Sections to Highlight on Form 990

Page 1 – Mission Statement

This is the summary page of Form 990. Ensure that the mission statement or most significant activities listed are accurate for the tax year being reported.

Page 2 – Program Services

Use this section to explain any new significant program services or accomplishments during the year. Break down your programs into detail to showcase your organization’s impact.

Page 5 – Tax Compliance – Statements Regarding Other IRS Filings and Tax Compliance

Highlight adherence with the organization’s mission and activities, and consider potential unrelated business income tax implications.

Page 6 – Governance, Management, and Disclosure

Prioritize documenting meetings and policies to demonstrate effective governance.

Page 7 – Compensation

Ensure that officer listings are accurate and in compliance with state and incorporation requirements.

Page 10 – Functional Expenses

Provide an appropriate level of detail for expenses to address potential questions from donors and stakeholders.

Page 11 – Balance Sheet

Understand and explain assets, liabilities, and net assets, especially those with donor restrictions. Net assets with donor restriction can hold restrictions based on purpose and / or time.

Schedule B – Contributors

Be mindful of donor contact information, especially for large contributors. Respect donor wishes for anonymity. This Schedule is NOT made public by the IRS

Schedule G – Fundraising Events

Detail fundraising events to align with the Statement of Revenues.

Schedule L – Transactions with Interested Persons

Consider voluntary disclosures for transparency.

Schedule O – Supplemental Information

Use this to explain and provide context for items previously disclosed on the form.

Schedule R – Related Organizations

List related tax-exempt organizations and explain the nature of the relationship.

By leveraging these sections effectively, your organization can turn Form 990 from a regulatory requirement into a powerful storytelling tool that showcases your mission, achievements, and commitment to transparency, ultimately strengthening your connection with donors, grantors, and the public.