Key Considerations When Finding a Financial Planner

Contributed by: Adam Rothbart,CRPC ® – Integrated Financial Partners (IFP)

Are you considering working with a Financial Planner? Maybe you have a current partner, but aren’t sure you’re getting the value needed from the relationship and are thinking of making a switch. Either way, it’s essential to define what you need for ROI out of a financial partnership as well as how to structure the engagement for success.

It’s important to remember that every financial situation is unique. Before meeting with a Financial Planner, it’s critical to take the time to explore internally what it is you really want from an advisory relationship, and make that clear to the advisors you’re meeting with (the good ones will tell you whether or not it’s a good fit). However, some general guidelines to consider may include:

Before anything: Reacquaint yourself with your money

Your initial investment in the financial planning process should not be a monetary one. Often the most valuable first step is an investment of time, time spent reacquainting yourself with your finances by asking yourself two questions:

- Where is my/our money going?

- How do I/we feel about that?

A great place to start is by going through your bank/credit card statements from the last 12-months. Categorizing each payment into essential, such as:

- Mortgage

- Utilities

- Groceries

Outline essential–adjustable expenses; must-have or must-pays that could be restructured, and may include:

- Vehicle payments

- Personal debt/loans

- Cell phones

- Daycare

- Insurance

Finally, list discretionary expenses, which will encompass everything else. A best practice for discretionary costs is to create subcategories as well – the more, the merrier!

For some, this process is enjoyable, comes naturally, and leaves them feeling empowered and tranquil. For most, the exercise is agonizing. You may not like what you see – and you may feel overwhelmed, anxious, ashamed, and helpless. Without this self-awareness, though, we subscribe to complacency, which, over time, can cause undue stress and adversely affect your relationships, self-esteem, and career. If you fall into the latter category, or you know you’ll never do this exercise, it may be best to explore the efficacy of a long-term, more comprehensive financial planning engagement (details in next section). If you fall into the former category and are willing to continually invest your time, consider a short-term engagement (also detailed in next section), as you may just need some coaching, validation, and an action plan to confidently implement the foundational components of a strong financial plan.

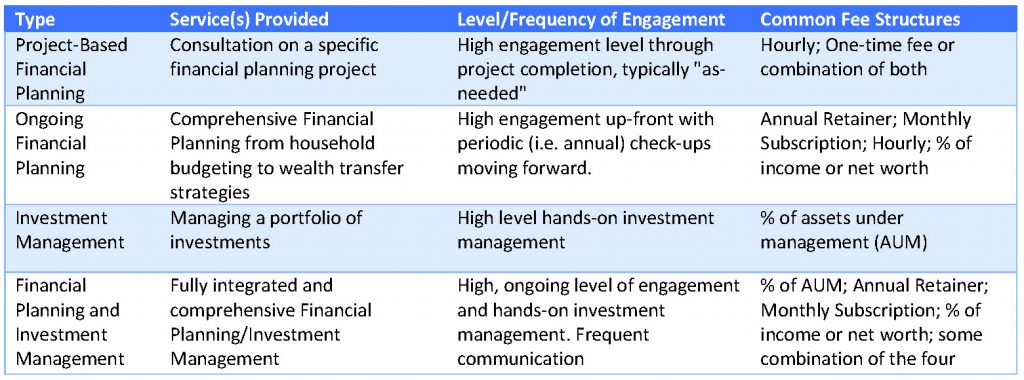

Context: Advisor/Client Relationship and Fee Structures

There are many ways to structure an advisory relationship, and figuring out which is best for you can be challenging. Below are the more common fee-based engagement structures, meaning the client pays a clearly defined fee to a fiduciary for advisory services. It’s important to remember that many “financial advisors” are brokers who are paid a commission if/when you purchase a financial product, and any financial advice they provide must be considered “solely incidental” to the recommendation that you purchase said product. This is a very important distinction to be aware of as you move through the process.

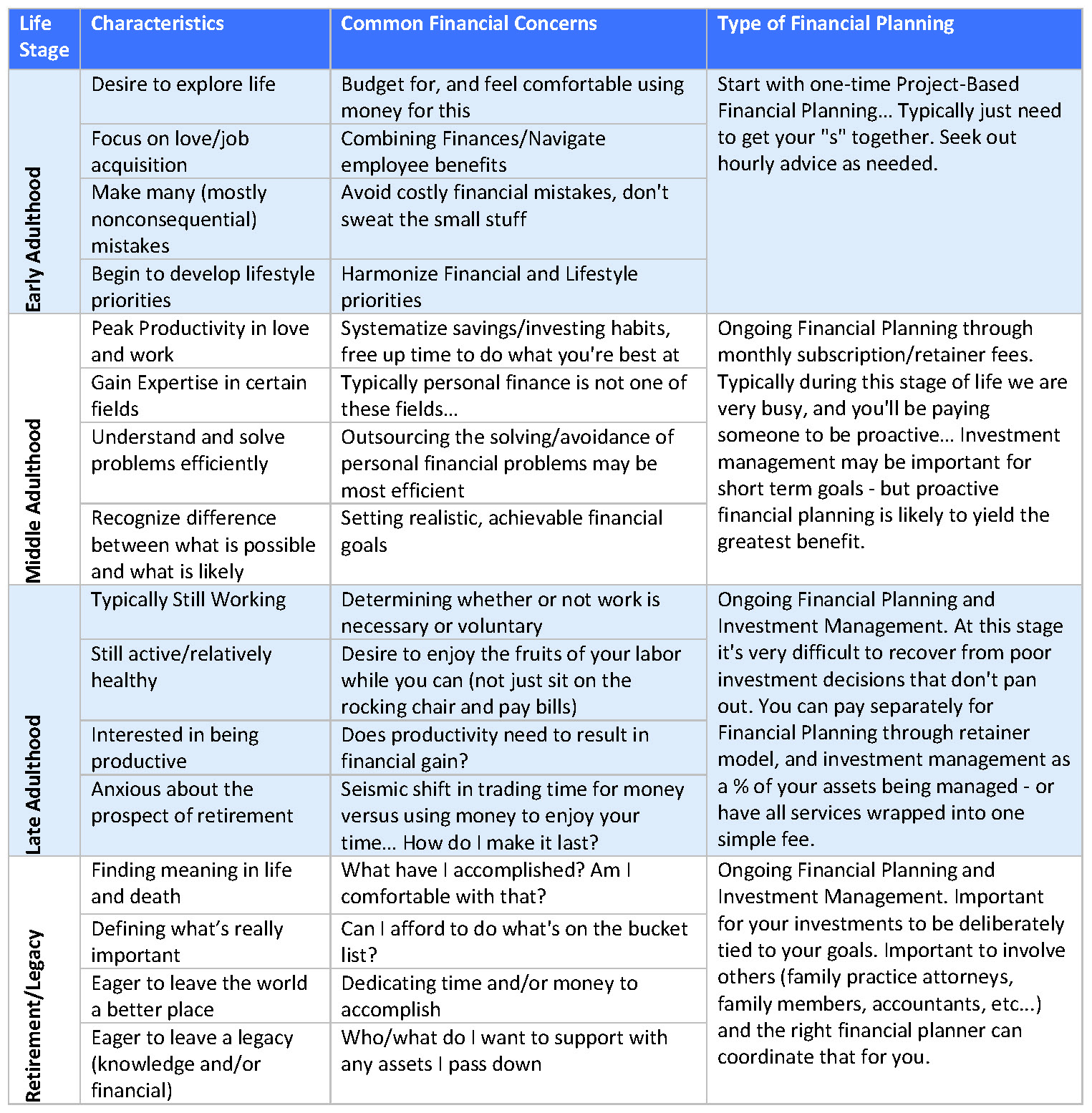

What’s best for me?

It’s impossible for anyone but yourself to accurately answer this question. That being said, a recommendation on where to start should save you some time and help get you on the path to financial wellness. I feel the best way to address “what’s best for me?” is by aligning the financial planning type and fee structure with “life-stage” demographics.