Freedom Planning for Business Owners

Guest Contributor: Adam Rothbart CRPC® Financial Planner, Integrated Financial Partners

Retirement Freedom Planning for Business Owners

Establishing Context: Financial Independence vs. “Brochure-Cover-Retirement”

The thought of retirement is often met with fear and anxiety, leading to various degrees “planning paralysis.” If we are able to view retirement through a different lens, the feelings of fear and anxiety may be replaced by anticipation and confidence. There are, of course a wide range of complexities that come with this phase of life that ought to be addressed. However, much of the retirement planning process is futile until our financial destinations are defined.

Changing The Lens On Retirement Savings

What if we looked at this phase of life not as “brochure-cover-retirement” (beaches and Adirondack chairs), but as freedom – having the freedom to do what you want, when you want, where you want. Only you can define what it is you want to do, when and where you want to do it. These intersections of what, when, and where are often referred to as “goals”, “aspirations” or “wishes”. I prefer “destinations”.

Goals are typically broad; for example “my goal is to achieve financial independence before my oldest graduates from college.” To quote financial planning thought leader, Michael Kitces, defining financial independence: “your time is now financially independent of what you do with it. So do whatever you want with your time. If it makes money, that’s cool, if it doesn’t, that’s okay as well, your time is financially independent. Now do whatever it is that’s rewarding.”[1] Using the hypothetical goal above, we can now define and work toward the destination through a comprehensive financial planning process… We have a time horizon – oldest graduating from college, and from there we can determine what is necessary to achieve financial independence for you – which may be “I need $1.6 million by May 1, 2025.” Where you are now is “Point A”, $1.6 million, by May 1, 2025 is “Point B” – now we can create a plan that’s relevant.

Transitioning from Business Owner to whatever’s next: Financial Readiness

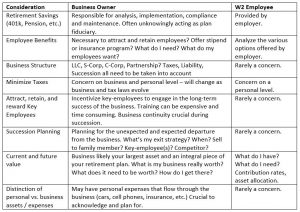

For business owners, retirement (or freedom planning) comes with added complexities. Some of these complexities are more technical in nature. However it’s paramount to address the emotional complexities as well. A table illustrating some of the more basic, technical considerations that can impact retirement for a business owner versus W2 Employee:

The common denominator above is, as a business owner, you’re in full control of your own destiny. As time goes on, financial independence can be more clearly defined, which will help dictate the outcome of each consideration. As the time horizon to your financial destination lessens, the margin for error becomes smaller. The technical aspects of transitioning to financial independence are very manageable, as long as you are willing to participate in the process and have a great team in place to help you execute.

Transitioning from Business Owner to Whatever’s Next: Mental Readiness

In my experience, the more significant hurdle is often the emotional one. Many entrepreneurs (including myself) have spent their entire adulthood building their business from the ground up. There were seemingly impossible challenges to overcome; markets (or perhaps your entire industry) changed, technology evolved, and customer needs shifted. It’s likely that the only constants throughout your career were a combination of intangibles; grit, work ethic, faith, love, stubbornness, passion, support – to name a few. Your business and your surname may be the same. You built a brand, a reputation, and trust in the business and geographic community. You may have sponsored little league teams and watched the next generation chase their dreams of becoming a professional athlete while wearing a jersey bearing your business’ logo. You likely not only provided for your family, but dozens or hundreds of other families through your employment.

Again, only you can define what life after business ownership (retirement) looks like. For most of my business owner clients, this phase of life is not beaches and Adirondack chairs. You may want to teach, give back to the community that supported your business, start another business, volunteer, work at Home Depot and get discounts on tools, learn a new skill, mentor others, etc. With this in mind, we have an entire team dedicated to helping business owners successfully execute this transition. The whole process begins with analyzing and measuring “Financial” and “Mental” readiness to exit your business. The likelihood of true fulfillment increases substantially when financial and mental readiness are in harmony.

Contact Leone, McDonnell & Roberts today

Download some of the included visuals and questionnaires from our resource library for more information on retirement and future planning. Or, contact the Leone, McDonnell & Roberts team today to discuss your specific version of freedom planning.

[1] Michael Kitces, Financial Advisor Success Podcast Ep. 091: Increasing The Value Of Advice By Focusing On Life-Centered Planning For Transitions Not Goals with Mitch Anthony, kitces.com/91.