CPA Exam Update: What Changes Do You Need to Know

Believe it or not, changes are coming to the infamous CPA exam.

Starting in January 2024 the CPA exam will see major changes to the format of the exam and knowledge required. Here is what you should know about the changes that are coming:

- New Technology Focus

Technology is evolving and becoming more relevant to businesses and the accounting profession. The new CPA exam is evolving to reflect the importance of innovation in the industry. The new exam will have new technology focuses throughout the test. Some areas where candidates will need to demonstrate their knowledge of technology within the profession is determining methods to transform data to make it useful for decision making, verifying the completeness and accuracy of source data, and using the outputs of automated tools, visualizations, and data analytic techniques.

- Format Changes

The current CPA exam consists of four sections: Audit & Attestation (AUD), Business Environment & Concepts (BEC), Financial Accounting & Report (FAR), and Regulation (REG). A candidate must pass all four sections to obtain their license. The new format looks to keep the three “core” sections but will separate the BEC section into a “discipline” section where candidates can select one of three possible options. Many accountants tend to lean toward one aspect of accounting in which they enjoy more (ex: auditing or tax). The goal of this new format is to provide a test catered toward specialties that a candidate might have chosen in their graduate programs or electives they enjoyed in their undergraduate programs.

The new sections include:

Business Analysis and Reporting (BAR) – Catered toward candidates who are interested in assurance or advisory services, financial statement analysis and reporting, technical accounting, and financial and operations management.

Information Systems and Controls (ISC)– For candidates interested in assurance or advisory services related to business processes, information systems, information security and governance, and IT services.

Tax Compliance and Planning (TCP) – For candidates who are interested in taxation topics involving more advanced individual and entity tax compliance.

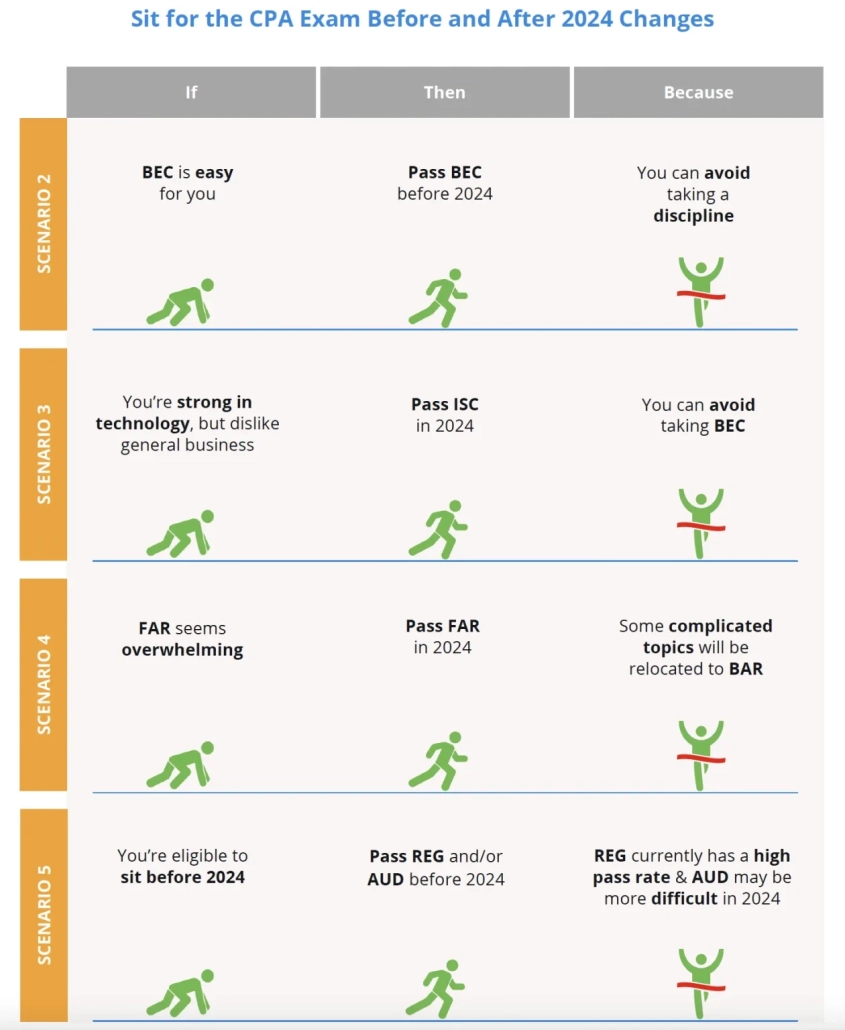

- Candidates currently in the middle of the exam process might be affected by this change

If you have passed the sections already, your credits will count toward the corresponding “new” test sections, and you will not have to repass the sections. However, if you have exceeded the timeline in which you have to pass all four sections and you need to retake a section, you will need to retake the “new” exam section. These changes may also impact the order in which a candidate might choose to take the exam.

Below is a chart which lays out a few scenarios to consider with the changes coming in 2024.

Photo Source: https://accounting.uworld.com/cpa-review/cpa-exam/changes/2024-cpa-evolution/

While there is a blueprint for the new exam, there are still question marks and adjustments to make in the future. For someone considering taking the exam, I would recommend purchasing a study pack to assist in the process. These are created by professionals and will be catered toward the new format as well as the new focus on technology.