Getting Back to Basics: Debits and Credits

Debits and credits are prime examples of things that may seem simple—but can actually be rather complex. Debits and credits are essential components in the accounting world and are critical to maintaining accurate and balanced books. They are the foundation of double-entry bookkeeping and are used to determine the financial position of a business.

Why are debits and credits so important to understand?

Understanding your debits and credits is crucial to ensuring that your balance sheet, income statement, and other financial documents are accurate. They are also useful in understanding account balances and whether they have increased or decreased.

For starters, what exactly are debits and credits?

Debits and credits are equal amounts that appear on opposite sides of your books.

A debit (sometimes seen as DR) is an entry made on the left side of an account, which increases an asset or expense account, or decreases a liability, revenue, or equity account.

A credit (sometimes seen as CR) is an entry made on the right side of an account, which increases a liability, revenue, or equity account, or decreases an asset or expense account.

Something I learned in my very first accounting class was the acronym DEAD:

Debit

Expenses

Assets

Dividends

Essentially, you debit expenses, assets, and dividends to INCREASE their value. Debiting any other account would decrease its value. The books would be DEAD without understanding this rule.

Debit and Credit Accounts

The following account categories are those primarily affected by debits and credits:

- Assets

- Expenses

- Liabilities

- Equity

- Revenue

When we think of the accounting equation, Assets = Liabilities + Equity (A = L + E), we know the equation always applies and is the end result that every accountant looks for. Debits and credits essentially keep this equation in balance. If we increase (debit) an asset account, we must also a) decrease (credit) another asset account or b) increase (credit) a liability or equity account for the same amount. Equal, but opposite.

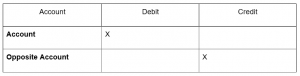

A journal entry tends to appear as follows:

Having a firm grasp on how debits and credits work helps to keep your financials in good order and allows you to understand the financial activities and health of your organization and influence business and financial decisions.